Stocks with the potential.

The best stocks for dividends. Value investing.

What to buy now.

Stocks with a low P/E P/S P/B P/C PEG, from enterprises with a earnings growth

Which share to buy, the best stock for now. The value investing method.

Also Warren Buffett, Benjamin Graham and Peter Lynch could like some of these stocks.

Using the strategy and method of Warren Buffett, Benjamin Graham, John Templeton, Peter Lynch,

we can buy these stocks.

I bought also some of these stocks for my fund in the value investing style. There are no better stocks in Europe and the USA.

Fundamental Analysis:

www.morningstar.com ,

finance.yahoo.com ,

www.onvista.de ,

Focus Money, Handelsblatt, Euro am Sonntag, Börse Online.

Technical analysis, stock chart and indicator MACD, RSI :

stockcharts.com +

www.comdirect.de

When to buy the stocks, shares :

P/E = KGV = price/earnings = good is < 15, better < 10.

P/S = KUV = price/sales = good is < 3, better < 1.

P/B = KBV = price/book value = good is < 3, better < 1.

P/C = KCV = price/cash flow = good is < 15, better < 5.

PEG = P/E/earnings growth = price/earnings/earnings growth = the best is < 1.

Earnings growth is good > 20% this year and the next year too.

ROE = return on equity = Eigenkapitalrendite, is good > 15%.

Earnings = Gewinn = beneficio, book value = Buchwert = valor contable, sales = Umsatz = ventas.

When to sell the stocks : With P/E 25 or P/B 6 or P/S 4 or if the earnings of enterprise

don´t grow. Never use stop loss order !

Never sell at a loss, wait some years for a profit !

Stocks for this year or forever - value investing - tips

Cheaply valued stocks. USA, Canada, Europe, Japan, Australia. VALUE INVESTING

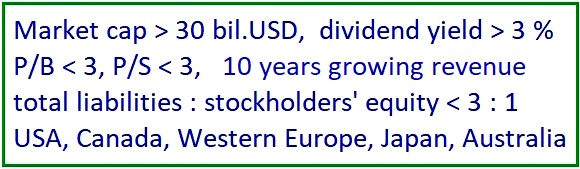

Market cap > 30 bil. USD, dividend yield > 3 %, P/S < 3, P/B < 3.

USA

AT&T Inc. (T) P/E P/S P/B

Chevron Corp. (CVX) P/E P/S P/B

Exxon Mobil (XOM) P/E P/S P/B

Pfizer Inc. (PFE) P/E P/S P/B

Verizon Communications Inc. (VZ) P/E P/S P/B

Canada

Enbridge Inc. P/E P/S P/B

Suncor Energy P/E P/S P/B

Great Britain

BP PLC P/E P/S P/B

NatWest Group P/E P/S P/B

Shell PLC P/E P/S P/B

Tesco PLC P/E P/S P/B

Germany

Allianz SE P/E P/S P/B

BASF SE P/E P/S P/B

BMW AG P/E P/S P/B

Deutsche Telekom AG P/E P/S P/B

Mercedes Benz AG P/E P/S P/B

Munich Re AG P/E P/S P/B

Japan

Canon Inc. P/E P/S P/B

Honda Motor Co. P/E P/S P/B

KDDI P/E P/S P/B

Mitsubishi Corp. P/E P/S P/B

NTT P/E P/S P/B

Takeda Pharmaceutical Co. P/E P/S P/B

Toyota Motor P/E P/S P/B

European Union

AXA SA P/E P/S P/B

BNP Paribas P/E P/S P/B

Credit Agricole P/E P/S P/B

Eni SpA P/E P/S P/B

Iberdrola SA P/E P/S P/B

Orange SA P/E P/S P/B

Sanofi SA P/E P/S P/B

TotalEnergies SE P/E P/S P/B

Australia

Fortescue Ltd P/E P/S P/B

Rio Tinto P/E P/S P/B

The intelligent investor like you and me and Warren Buffett,

John Templeton, Peter Lynch , Ben Graham:

The most profitable pension insurance are the dividends from stocks with a low P/E, P/S, P/B, from

stocks with above average dividends, from old and large enterprises and banks with earnings, sales and

dividend growing 10% annually in the past 10 years, from the USA, western Europe and Canada. So we have

the pension at once and since the year of stock purchase and our dividends are each 8-10 years double.

The company must not be affected by the competition, it needs an economic moat against competitors.

These stocks we will hold non-stop forever. They can fall 50% in each one decade, but a capital growth

about 160% will stay each one decade and our children will inherit our stocks.

People must pay into a normal pension insurance at least 12 years, or the pension is available at 65 years.

The pension will be double after 70 years and children will not inherit it.

Stop loss order: we must avoid it, because when we buy cheap stocks and the company's earnings growth,

we don't sell stocks at a loss in a bad mood. We should wait some years for a high profit, until the share

will be overpriced, or the company's earnings will no more grow.

After the purchase, the share can fall 30% because of a correction. The stocks bought for dividends as

a pension bought and forever held, they can fall 50% each one decade. But they will be again at the top

after 4-6 years and they will never be sold, because only the dividends are important. Technology stocks and

cyclic stocks will be sold after some years, when they will be overpriced, or the company's earnings

will no more grow.

Rating avoid. All banks, rating agencies and magazines publish the rating BUY - SELL or a recommendation

total reversed, we must turn it around. Because they promote overvalued stocks, or stocks from companies

with dropping earnings. But we should buy cheap stocks with a low P/E, P/S, P/B, from enterprises with growing

earnings. The rating, the target price, the price target are a fraud and criminal and nobody should publish

it, nor participate on this fraud. The technology stocks and cyclic stocks hold for 2-7 years are

attractive, if the company's earnings grow at least 20% this year and later too.

|

American forum and a discussion about stocks

in English from New York = a Facebook group

American forum and a discussion about stocks

in English from New York = a Facebook group

the book

the book

value investing picture

value investing picture